-

Top Employment Lawyer in San Jose

Recently, ThreeBestRated.com identified Steven P. Cohn as a leading provider in the field of employment law in San Jose. Based on reviews and testimonials, the company determined that Mr. Cohn stood out from other attorneys, and duly selected him as one of the top three employment lawyers in San Jose. Mr. Cohn has more than

35 years of legal experience and specializes in workplace discrimination and harassment, disability, whistleblowing, unlawful business practices, and wrongful termination . Congratulations on the recognition, Mr. Cohn!

35 years of legal experience and specializes in workplace discrimination and harassment, disability, whistleblowing, unlawful business practices, and wrongful termination . Congratulations on the recognition, Mr. Cohn!If you have benefitted from Mr. Cohn’s legal expertise, please leave a review on our Google+ page. We appreciate your feedback!

-

Attorney Steven P. Cohn Honored with Prestigious Award

We are proud to announce that Steven P. Cohn has been recognized for the prestigious National Advocates Top 100 Lawyers .

The National Advocates Top 100 Lawyers seeks to identify the top 100 attorneys who exemplify their duties as they represent individuals in their legal specialties. These attorneys demonstrate leadership, influence in their community, and premier performance.

The Advocacy Center for Employment Law specializes in employment and labor law with a focus on harassment and discrimination litigation. The firm also addresses civil rights violations, unfair business practices, workplace sexual harassment, and unlawful discrimination.

-

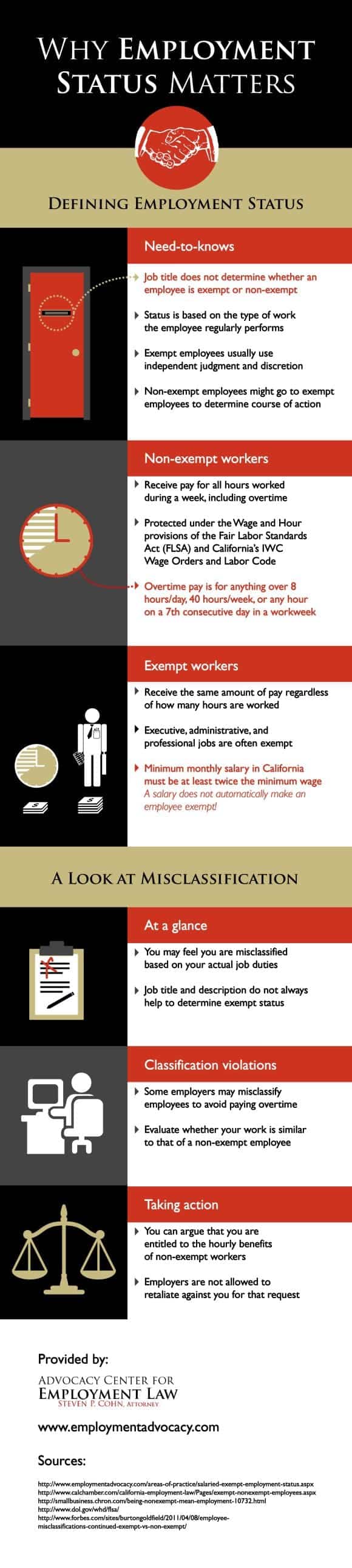

Why Employment Status Matters [INFOGRAPHIC]

If you’re like most people, you work hard at your job to make a living and provide for yourself and your family. No matter what industry you enter, your employer should be classify you as either an exempt or non-exempt employee. Non-exempt employees are entitled to overtime pay for time worked more than 40 hours per week, while exempt employees are paid the same amount, regardless of time worked. If you are an exempt employee in San Jose but feel you are entitled to the same benefits as a non-exempt worker, you may need an employment lawyer to get you the wages you deserve. Take a look at this infographic to learn more about employment status, and to learn why your classification matters. Please share with your friends and family.

-

Steps to Take If You’ve Been Misclassified as an Independent Contractor

California laws provide protections and relief for workers that have been misclassified as an independent contractor. Classifying employees as independent contractors offer companies significant savings, since they do not need to pay the employer-portion of Medicare and Social Security taxes, nor do they need to provide workers’ compensation insurance, unemployment insurance, and other rights and benefits, such as overtime or meal and rest breaks. If your employer has been treating you as an employee, yet has been classifying you as an independent contractor, you should consult an employment lawyer for clarification about your rights, time limits, and possible recovery.

1. Discuss the Matter with Your Employer

If you have a good relationship with your employer, you may wish to ask them to review your classification. If your employer decides not to reclassify you or refuses to review your classification, try to obtain an explanation, preferably in writing, as to why your employer has classified you as an independent contractor. If you still think that you should be classified as an employee, contact an employment lawyer to discuss your options and to review your employer’s explanation.

2. Factors that Determine Whether you are an Employee or Independent Contractor

There is no set definition of the term “independent contractor”. In handling a matter where employment status is an issue, the DLSE presumes that you are an employee. Your employer must present evidence to rebut this presumption in order to show that you are properly classified as an independent contractor. After looking at all of the evidence, a judge will then apply a number of factors, all of which must be considered, and none of which is controlling by itself. These factors are sometimes referred to as the “economic realities” test.

In applying the “economic realities” test, the most significant factor to be considered is whether the person to whom service is rendered (the employer or principal) has control or the right to control the worker both as to the work done and the manner and means in which it is performed.

Additional factors that the DLSE may consider are:

-

Whether the person performing services is engaged in an occupation or business distinct from that of the principal;

-

Whether or not the work is a part of the regular business of the principal or alleged employer;

-

Whether the principal or the worker supplies the instrumentalities, tools, and the place for the person doing the work;

-

The alleged employee’s investment in the equipment or materials required by his or her task or his or her employment of helpers;

-

Whether the service rendered requires a special skill;

-

The kind of occupation, with reference to whether, in the locality, the work is usually done under the direction of the principal or by a specialist without supervision;

-

The alleged employee’s opportunity for profit or loss depending on his or her managerial skill;

-

The length of time for which the services are to be performed;

-

The degree of permanence of the working relationship;

-

The method of payment, whether by time or by the job; and

-

Whether or not the parties believe they are creating an employer-employee relationship may have some bearing on the question, but is not determinative since this is a question of law based on objective tests.

The DLSE will also find an employer-employee relationship if (1) the employer retains extensive control over the whole job operation, (2) the employee’s duties are integral to the operation, and (3) the nature of the work would not require detailed control.

The DLSE will also find an employer-employee relationship if (1) the employer retains extensive control over the whole job operation, (2) the employee’s duties are integral to the operation, and (3) the nature of the work would not require detailed control.Speaking with an employment lawyer about these factors is critical , as their experience with past clients, and their knowledge of other cases, can help think of creative ways to fit you within these factors and establish your status as an employee.

-

-

A Closer Look at California Overtime Laws

Overtime pay is generally owed to all non-exempt employees who work more than eight (8) hours in a work day, or more than forty (40) hours in a work week, or for any hours worked on a seventh (7th) consecutive day of a work week.

1. How Is Overtime Compensation Calculated?

Employees who are entitled to overtime must receive at least one and one-half times their regular hourly rate of pay for overtime hours that they work. If the employee works longer than twelve (12) hours in one day, or over eight (8) hours on a seventh (7th) consecutive day of work, they are entitled to overtime at a rate of double their regular hourly rate of pay (sometimes referred to as “double-time” instead of “overtime”).

Since there are complicated exceptions and exemptions to California’s overtime law, you should contact an employment attorney if you believe that you are owed overtime for hours that you have worked.

2. How Can I Recover Overtime Wages an Employer Refuses to Pay?

If you worked overtime hours, but you did not receive compensation equal to what is described above, your employer may owe you back pay and may also be required to pay certain penalties to both you and the State. California provides workers with a free, streamlined administrative process to recover back pay, other wages, and penalties through the Labor Commission, under the Division of Labor Standards Enforcement (DLSE). An employment attorney can help you file a Claim with the DLSE, and represent you at the mandatory Conference and Hearing.

-

Salaried Workers and Overtime: What You Need to Know

Are you considered an exempt employee in San Jose? If you are a salaried worker, you might assume the answer to be yes. Many people do, and as a result, they are denied the compensation they are owed for their overtime hours. Overtime pay is a right not just for hourly workers; salaried employees may also be eligible for this type of income depending on their employment status. Knowing whether you are accurately classified as an exempt or non-exempt employee is the first step towards receiving the compensation you deserve.

Are you considered an exempt employee in San Jose? If you are a salaried worker, you might assume the answer to be yes. Many people do, and as a result, they are denied the compensation they are owed for their overtime hours. Overtime pay is a right not just for hourly workers; salaried employees may also be eligible for this type of income depending on their employment status. Knowing whether you are accurately classified as an exempt or non-exempt employee is the first step towards receiving the compensation you deserve.1. Employment Status

Workers’ rights vary depending on whether you are an exempt employee or a non-exempt employee. The category that you fall into depends on the nature of your position. For instance, if you have an administrative or executive title, you may be exempt from overtime pay. However, many other positions carry a non-exempt status. One of the easiest ways to determine if you are a non-exempt employee is to track whether your wages have ever been reduced because you arrived late to work one day or had to leave early to pick up your child from school. If so, you are likely a non-exempt employee.

2. Overtime Stipulations

Under most circumstances, overtime pay is due to non-exempt employees who work more than 8 hours in a day, 40 hours in a week, or seven consecutive days in one workweek. Regardless of whether you work only a single hour past 40 hours once a month, or you regularly work 10 hours or more past 40 in a single week, you have the right to overtime pay.

3. Pay Request

Asking your employer to provide legitimately owed overtime pay is your right, but it should be done with the proper precautions in place. First, you should submit your overtime request with written documentation. Second, you may want to contact an employment attorney before you move forward with your request. A labor lawyer is well versed in workers rights and can help you get the wages you are due. Should your employer dismiss you for your overtime pay request, an employment attorney could prove integral to getting capable legal representation and a fair settlement for a wrongful termination claim.

-

Answering FAQs About Wage Claims

Employees often refrain from making wage claims near San Jose for fear that it might jeopardize the relationship they have with their employers. However, employment laws clearly outline workers’ rights afforded to eligible employees. Should they not advocate on their own behalf for the rights due to them, they may be deprived of considerable income over the course of their working careers. If you have questions about legitimate wage claims, the following answers can help you better understand your rights.

Employees often refrain from making wage claims near San Jose for fear that it might jeopardize the relationship they have with their employers. However, employment laws clearly outline workers’ rights afforded to eligible employees. Should they not advocate on their own behalf for the rights due to them, they may be deprived of considerable income over the course of their working careers. If you have questions about legitimate wage claims, the following answers can help you better understand your rights.1. What happens to unused vacation time if you leave a job?

Perhaps you are moving on to a new career opportunity. As you reconcile the final details of your current job, you realize that you have unused vacation hours. In such a case, your soon-to-be former employer must pay you for those vacation hours. Earned vacation time demands payment the same as the hours you worked in a regular day. Should your employer refuse to pay out your vacation time, you may want to speak with an employment lawyer to see if you should file a wage claim .

2. How many breaks should you get during each workday?

Wage claims may also be warranted if you must work through your mandated break periods. First, you must determine if you are a non-exempt employee. If you have this employment status, next consider the number of hours you work each day. Many employers expect their employees to be at work for at least eight hours. If this requirement applies to your work situation, you should receive a half-hour lunch break. After a four-hour period, you are likewise entitled to a 10-minute break that must be given again after four more consecutive hours.

3. Why should you hire an employment lawyer for your wage claims?

Labor laws are in place to protect your rights as a worker, but these can be difficult to understand without the necessary legal training. If you suspect that you have a wage claim because of wages not received from earned vacation time, missed break periods, or overtime hours, talk with a labor lawyer. Especially if you fear that you may be wrongfully terminated for your wage claim, an attorney who is knowledgeable in employment law can offer you the best possible legal outcome.

-

A Guide to Your Rights as a Minimum Wage Worker

The Fair Labor Standards Act governs employment law in San Jose through federal minimum wage provisions. As of July 24, 2009, the federal minimum wage is $7.25 per hour. However, many states have their own minimum wage laws, with some states providing greater employee protections.

1. Covered Employees

1. Covered Employees The Fair Labor Standards Act establishes minimum wage, overtime pay, and child labor standards throughout the country. While states can implement a higher minimum wage, they must also comply with the federal minimum wage standards. The employment law provisions of the FLSA apply to businesses with employees who participate in interstate commerce, produce goods for interstate commerce, or work with goods that have been moved in or produced in the stream of interstate commerce. However, the Act does not regulate hospitals, institutions engaged in the care of sick, schools, or institutions of higher education. As a result, these types of employees must file their wage claims under other legal remedies.

2. Basic Provisions

The Act requires covered employers to compensate their employees a minimum wage of $7.25. Additionally, employers cannot pay workers under the age of 20 less than $4.25 an hour during the first 90 consecutive calendar days of employment. It is also illegal for an employee to displace a separate employee to hire a youth worker. Even though employers may pay on a piece-rate basis, employees can file hour claims if they don’t receive the equivalent of the required minimum hourly wage rate and overtime. While the Act does not limit the number of overtime hours an employee can work, it does require employers to compensate employees at least one and one-half times their regular pay rate for overtime pay.

3. Penalties and Sanctions

An employee can speak with an employment attorney about FSLA violations, but the Department of Labor also uses a variety of remedies to enforce compliance with the Act. If the Wage and Hour Division Investigators notice violations, they will recommend changes in employment practices so that the employer is in compliance with the Act. They will also require employers to pay employees for any back due payments.

-

Employee Misclassification: Are You a Victim?

In 2011, Levi Strauss made national news when the company agreed to pay more than one million dollars in back wages to employees it misclassified as exempt from overtime pay. Unfortunately for a non-exempt employee in San Jose , many companies struggle with the definition of exempt and non-exempt employees. While the rules governing this type of employment law are complex, the practical implications of these classifications are rather straightforward.

1. Tests for classification

1. Tests for classification The Federal Labor Standards Act outlines three tests for classifying an exempt employee and a non-exempt employee. In most cases, the employee must satisfy all three tests to meet the definition of exempt. First, an employee is considered exempt if he or she earns more than $100,000 per year. Employees earning less than $23,600 per year are classified as non-exempt. The second requirement is the salary basis test, which classifies employees as salaried if they receive a guaranteed minimum amount of money for weekly work. The final test is the duties test, which looks at the actual job tasks and how the position fits into the employer’s overall operations.

2. Reclassification of employees

Identifying misclassified employees is just the first step in solving this employment law issue. The employer needs to calculate a new hourly wage rate and compensate the employees for any overtime wages owed. If the employee salaries were already quite high, it may be difficult to convert those to an hourly rate that isn’t considerably higher than competitive market rate. In this type of situation, it may be useful to meet with an employment attorney about reclassifying employees and providing compensation for back wages.

3. Management training

Employers may need to meet with an employment attorney to calculate the amount due to each misclassified employee and benchmark a competitive new hourly rate. This ensures that the affected employees don’t earn any less than they did with their exempt statuses. Next, employers should train managers on workplace rights for hourly employees and how to educate their employees on rights regarding overtime wages. An attorney can help the employer reach a settlement for back pay with the affected employees.

-

What Deductions Can Your Employer Make from Your Salary?

Unlike a non-exempt employee, an exempt employee works for a salary. This means that an employer pays an exempt employee the same amount every week. Even though employers can make deductions from the salary of an exempt employee in San Jose, these deductions are limited to very specific circumstances.

In this video, an employment attorney outlines the reasons why an employer may be able to deduct an exempt employee’s salary. For example, if an exempt employee has exhausted or has not accrued enough sick leave, then the employer does not need to pay for a full day taken off of work. However, the key to this deduction is that the exempt employee must take the entire day off of work. An employer may also suspend an exempt employee without pay if the employee commits a serious violation, such as disregarding a major safety rule or instigating sexual harassment.